This work instruction is part of the guide Setting up your insurance solution.

Insurance market

In the insurance market, different parties can be involved in the flow of premium payments and commissions. Although a customer may experience the process as straightforward, the underlying financial routes can vary significantly depending on the agreements between Insurance Company, Managing General Agent/Proxy, Insurance Agent and/or Broker.

For example, a customer may arrange their insurance through an proxy, yet the actual premium is still collected directly by the insurer. In other cases, the insurance agent collects the premium themselves and settles it with the insurer, who then compensates the intermediary through commissions.

In short:

- The Insurance Company (Verzekeraar) is the risk carrier. They are the entity that underwrite and bear the financial risk of the insurance policies. They design products, manage reserves, and ensure regulatory compliance.

- An Managing General Agent (MGA) or Proxy (Volmachtbedrijf) can act as a delegated authority between an insurer and agent or client. The insurer grants a mandate (volmacht) to a MGA to underwrite price, issue policies and handle claims on behalf of the insurer.

- An Insurance Agent (Tussenpersoon) are customer-facing intermediaries who advise, sell and service insurance products, typically representing one or more MGA’s or insurance companies.

- A Broker (makelaarskantoor) is typically a specialist intermediary working on complex or corporate risks, often not bound to a single insurance company. They represent a client, not the insurer. They negotiate bespoke policies and terms across multiple insurers, sometimes internationally.

Across the market, these variations lead to five commonly occurring money-flow patterns. Each pattern determines who collects money, who receives it first, and how commission and remuneration move between parties. Understanding these flows is crucial for configuring your processes in Novulo correctly.

Let’s outline five common variants so you can recognise and configure accordingly. Note that other variants are possible and in practice.

Now that you better understand the variant, let’s look into what is needed to come to a contract between two or more parties. You will need to configure your organisation, create the commission product, and set up a contract.

Configure your organisation

In Novulo, we manage contacts, which can be either organizations or persons. Each installation of Novulo is multi-tenant, meaning you can configure multiple organizations that “own” the application. In Novulo, we refer to these as My Organization.

A properly installed new application comes with a pre-configured My Organization you can edit.

- Click on ‘Contacts’ under Management.

- Add the column ‘Is my organization’.

- Here you will either see:

- multiple entries (e.g., one for an insurer, one for an agent and one for a MGA/proxy) imported from a dataset

- no organizations at all

From a dataset

- Open the contact you want to edit.

- Fill in the NAW (Name, Address, City) details.

- Under ‘More’ add ‘Management settings’ .

- Make sure ‘My organization’ is checked under ‘Organization settings’.

- Optionally, upload a logo.

- Add a bank account for financial operations (a placeholder is included in the dataset). You can manage bank accounts under ‘More’ > ‘Bank accounts’.

- Provide a Creditor ID if you plan to process direct debits.

- Provide a Creditor ID if you plan to process direct debits.

- Set up industrial classifications if relevant.

Configure multiple organizations to set up contracts.

Tip: In a single-organization setup, remove unused ‘My Organizations’ to avoid clutter.

Without a dataset

- Click the plus icon to add an organization.

- Fill in the NAW (Name, Address, City) details.

- Under ‘More’ add ‘Management settings’ .

- Fill out the details and make to check ‘My organization’ under ‘Organization settings’.

- Optionally, upload a logo.

- Add a bank account for financial operations (a placeholder is included in the dataset).

- Provide a Creditor ID if you plan to process direct debits.

- Set up industrial classifications if relevant.

- Click save.

Tip: > Accurate financial details ensure smooth processing of invoices and direct debits.

Register Employees

To ensure proper access control and auditing register the employees of ‘My organization’.

- Go to ‘Employees’ under ‘HR’.

- Click on ‘Add employee’.

- Set Is employer of to the correct organization.

- Select an existing person or click Add new person.

- Fill in employee details (start date, end date, email, etc.).

- Link the employee to a Rights profile to grant required permissions.

Why: > Linking employees ensures traceability and correct styling, permissions, and authorizations.

Create the “commission” product

- Go to Products and create a product with:

- Artikelnummer:

PProv - Type: Service

- Productgroep: Fees

- Eenheid: Policy

- Verkoopartikel: No (leave unchecked)

- Fee type: Renewal commission

- Belastingbepaling: Insurance tax

- Boekingsschema: Renewal commission

- Artikelnummer:

form more details on product setup, review SUIV product and Custom product setup.

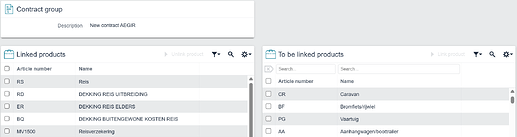

Add a contract group

- Under ‘Application management’ go to ‘Settings’.

- Search for product ‘Contract groups’.

- Click on the plus icon to add a new Contract product group.

- Set the description and click ‘Save’.

- Link the products that you want to include.

- Link the sales items that you want to include.

- Under ‘More’ add the ‘Used in contract lines’ to verify the product group is used in the specified contract. When you are starting a new contract group this line should be empty.

Note: Contract groups are used for contract, product groups are used in product and sales channels and product assortments are used for …

Configure a contract between an agent, insurer, proxy and other relationship

When you have configured your organisation, created a product and added relations, it is time to set up a contract. To create a new contract:

- Go to ‘Contracts’ under ‘Management’.

- Select or add the contact you want configure.

- Select the ‘Template’ Insurance.

- Add a description, period and in available a contract document.

- Click save.

- Add at least two stakeholders that are involved in this contract.

- Add ‘Contract lines’

- Fill out all details needed. Make sure to:

- Select the ‘Contract group’ with the products that are involved in this contract.

- Define a fixed or calculated price under the ‘Compensation’ panel.

- Define an invoice template.

- Under the tile ‘Products’ you will find an overview of the included products in this contract line.